Impact of trade blockade on inflation and external sector

Earlier, I briefly gave an outline of the impact of trade blockade on government expenditure and revenue in the first half of FY 2016. Here is a follow up brief blog on the impact of trade blockade on inflation and external sector stability. A good mid-year FY 2016 snapshot is provided by the IMF team here.

Earlier, I briefly gave an outline of the impact of trade blockade on government expenditure and revenue in the first half of FY 2016. Here is a follow up brief blog on the impact of trade blockade on inflation and external sector stability. A good mid-year FY 2016 snapshot is provided by the IMF team here.

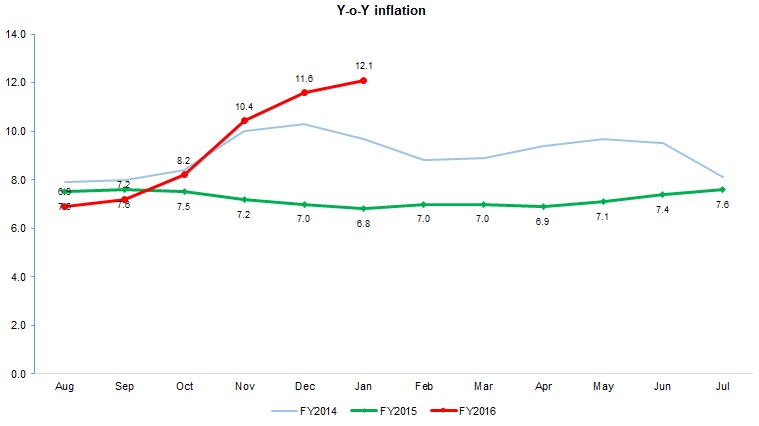

Inflation is creeping up fast: from 6.9% in mid-August 2015 to 12.1% in mid-January 2016. The last four months (when the supplies disruptions due to blockade was ongoing) had inflation higher than the corresponding months in FY 2015. The deviation from Indian inflation was also higher in all the first six months of FY 2016, which indicates not only the impact of the blockade (which is the primary source), but also the impact of supply-side constraints and anti-competitive practices within Nepal. Overall, food inflation (has 43.91 weight on CPI basket) was 15.2% in mid-January and non-food inflation was 9.7%. The blockade barred Nepali traders from importing goods at a relatively cheaper prices as a result of the sustained low oil prices globally.

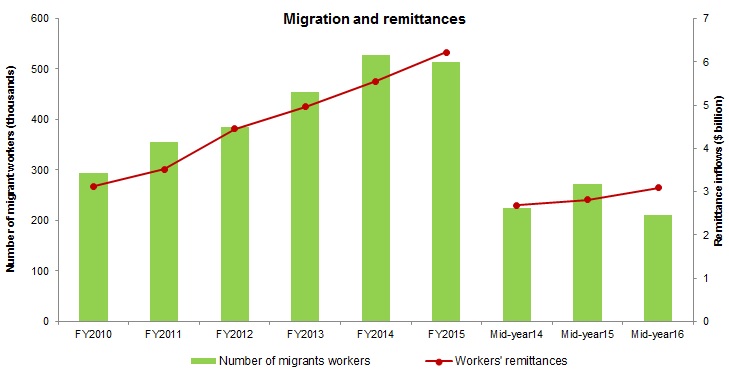

The impact of the earthquake, supply disruptions (which affected travel and operation of manpower agencies), and slow demand from migrant workers

from employment destination overseas (particularly due to the impact of low global oil prices in oil producing countries in the Gulf and Malaysia) lowered the number of workers leaving for work overseas.

from employment destination overseas (particularly due to the impact of low global oil prices in oil producing countries in the Gulf and Malaysia) lowered the number of workers leaving for work overseas.

However, workers' remittances have been increasing. At $3.1 billion by mid-year FY2016, it is higher than $2.8 billion by mid-year FY2015— a growth rate of 9.8% in dollar terms. This may slowdown in towards the end of FY2015 and in FY2016.

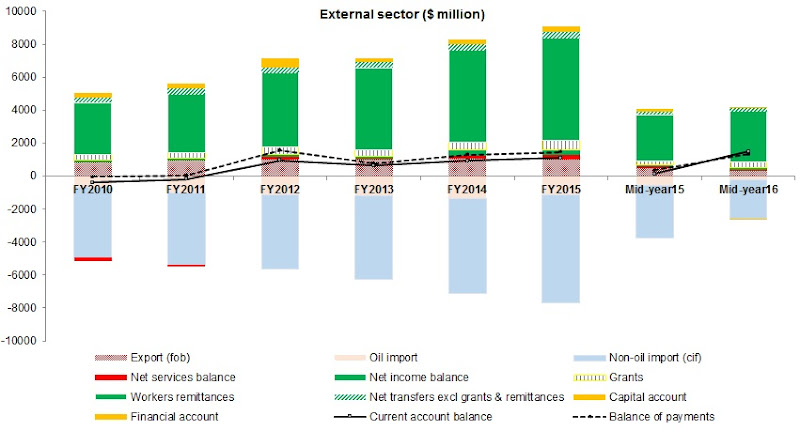

The decline in trade deficit (as blockade drastically lowered exports and imports) and an increase in workers’ remittance inflows boosted current account balance and balance of payments. Merchandise exports were down by about $178.5 million in the first half of FY2016 from the level in the corresponding period in FY2015. Similarly, imports went down by $1.2 billion, with oil imports plunging down by $381.6 million and non-oil imports by $790.1 million compared to the first six months of FY2015. Consequently trade deficit was down by $993 million. Current account surplus was $1.4 billion. Forex reserves are also up.

- Inflation may not come down anytime soon even though inflation in India is projected to be around 4.0% to 4.5% in the next fiscal year. Fuel and gas supplies have improved but they are far below the demand right now. Its lingering impact will continue to keep food and non-food prices at elevated levels.

- The hiring freeze by Malaysia is another major worry as it accounts for about 40% of total overseas employment. Similarly, the slowdown in Gulf countries due to low oil prices may depress the demand for Nepalese workers. Hence, remittances inflows may be affected negatively (even after factoring in the weak Nepalese currency against the USD). This may pose challenges in external sector stability, particularly current account balance and forex reserves.

- Exchange rate of Nepalese currency vis-à-vis the US dollar may remain volatile, following the movement of Indian rupee against the dollar.

- Depending on how event unfolds in the remaining months, GDP growth may swing anywhere between negative 1.8% to positive 0.5% in FY2016. Inflation will probably remain in the double-digits. Current account surplus will likely decrease.